Thursday, December 9, 2010

Glenn Beck Interestingly comes out in defense of Julian Assange

Hacker Threatens More Attacks on Those Seen as WikiLeaks Foes

By JOHN F. BURNS and RAVI SOMAIYA

Published: December 9, 2010

LONDON — In a campaign that had some declaring the start of a “cyberwar,” hundreds of Internet activists mounted retaliatory attacks on Wednesday on the Web sites of multinational companies and other organizations they deemed hostile to the WikiLeaksantisecrecy organization and its jailed founder, Julian Assange.

Let's call it the German 'Holiday' Village | Philadelphia Daily News | 11/30/2010

By CATHERINE LUCEY

Philadelphia Daily News

luceyc@phillynews.com 215-854-4172

It's that season again, which means that for the third year in a row, the German Christmas Village has set up a cozy collection of wooden booths and tree vendors in Dilworth Plaza on the west side of City Hall.

But a few shoppers noticed something amiss yesterday on the tall metal archways signaling the entrances to the shops. The archways had just one word on top - "Village."

Sounds festive, eh?

It turns out that the letters spelling "Christmas" were removed yesterday afternoon from the archways on the north and west sides of the plaza, at the request of Managing Director Richard Negrin. They will be replaced with the word "Holiday."

City spokesman Mark McDonald said Negrin asked for the change after the city received complaints from workers and residents.

"As a city of great diversity, one shouldn't be surprised that there's a difference of views when it comes to symbols and words," McDonald said.

CFR Michael Levi's Blog » Blog Archive » Solving Kyoto in Cancun

Just one cigarette can harm DNA, Surgeon General says but chemtrails are fine

While the report, out today, focuses on the medical effects of smoke on the body, it also sheds light on why cigarettes are so addictive: They are designed to deliver nicotine more quickly and more efficiently than cigarettes did decades ago.

Every exposure to tobacco, from occasional smoking or secondhand smoke, can damage DNA in ways that lead to cancer.

http://www.usatoday.com/yourlife/health/2010-12-09-1Asmoking09_st_N.htm?csp=34news

Most Americans Say They’re Worse Off Under Obama, Poll Shows - BusinessWeek

Dec. 9 (Bloomberg) -- More than 50 percent of Americans say they are worse off now than they were two years ago when President Barack Obama took office, and two-thirds believe the country is headed in the wrong direction, a Bloomberg National Poll shows.

The survey, conducted Dec. 4-7, finds that 51 percent of respondents think their situation has deteriorated, compared with 35 percent who say they’re doing better. The balance isn’t sure. Americans have grown more downbeat about the country’s future in just the last couple of months, the poll shows. The pessimism cuts across political parties and age groups, and is common to both sexes.

The negative sentiment may cast a pall over the holiday shopping season, according to the poll. A plurality of those surveyed -- 46 percent -- expects to spend less this year than last; only 12 percent anticipate spending more. Holiday sales rose by just under a half percent last year after falling by almost 4 percent in 2008.

“It’s definitely different this year than it’s been,” says poll respondent Larry Deyo, a 38-year-old father of two in Marlton, New Jersey. “I can’t really do too much with spending.” He says he lost his job at a kitchen and bath design center when the company closed, and he’s now working at a Home Depot Inc. store with a “significant decrease” in pay.

It was President Ronald Reagan who popularized the question, “Are you better off or worse off than you were four years ago” in his 1980 campaign against Jimmy Carter.

Wetlands landowners urged to get into Program AGENDA 21 in South Carolina

Blair recalled to face further questions on build-up to Iraq war - UK Politics, UK - The Independent

Tony Blair is to be recalled before the Iraq Inquiry to answer questions over whether he pressured his Attorney General to change his advice on the legality of the war.

The former prime minister will face a second session before the Chilcot inquiry in the new year – a year after he refused to express regrets over leading Britain to war in 2003. His statement provoked fury in the hearing, with members of the audience calling him a "liar" and a "murderer".

The decision to summon him back will be a blow to Mr Blair, who had hoped his previous six-hour appearance would defuse the continuing controversy over the war.

But it is evidence that the Chilcot team believes there are still significant gaps to be filled as they try to piece together a full picture of the build-up to war. They are preparing to question him over suggestions that he put pressure on Lord Goldsmith, who was then the Attorney General, to alter his advice on the legality of the war. The lawyer's change of heart just before the planned invasion gave a green light for British troops to join the US-led military action.

Mr Blair has denied attempting to influence Lord Goldsmith, but previously classified papers showed he queried the Attorney General's previous view that invasion without a new United Nations resolution would be illegal.

Designing an enforceable climate law - Unleashed (Australian Broadcasting Corporation)

I was at the UN Conference that agreed to the UNFCCC. I was dismayed that the Convention and its subsidiary agreements such as the Kyoto Protocol, would all be non-binding treaties. Any knowledge of international relations - or human nature - should tell us that a non-binding treaty on climate change is about as effective as a peace vigil in a bombing raid.

Let us contrast the climate treaty fiasco with that ancient, discredited treaty process which formed the beginnings of international public law.

The Vienna Peace Congress of 1814 was disparaged at the time but historians now agree that it set the tone and procedure for subsequent international law and prevented European wars from escalating into world wars, for 100 years. (In his PhD thesis, Henry Kissinger declared this the longest period of ‘peace’ that Europe has ever had.)

Plunging Home Prices Fuel Property Tax Appeals Swamping U.S. Cities, Towns - Bloomberg

A fiscal flood that threatens to swamp local government budgets across the U.S. overflows from file cabinets in the office of Patty Halm, chair of the Michigan Tax Tribunal.

The backlog of cases from taxpayers seeking to lower property-tax bills of more than $100,000 shot up to 14,236 this year from an annual average of about 6,000 during the past decade. The backlog of smaller claims was at 28,558 at the end of September, eight times higher than a decade ago, according to records at the tribunal, a Lansing-based administrative court.

Global Economy Faces Higher Capital Costs, McKinsey Study Says

Dec. 9 (Bloomberg) -- The global economy faces an imminent end to three decades of low interest rates as emerging markets embark upon a building boom and aging populations drain savings, according to McKinsey & Co.

A shift toward investment and away from savings is set to drive up the cost of capital with long-term interest rates possibly starting to rise within the next five years, the research division of McKinsey, the international consulting firm, said in a study released today.

“Everyone who is in business has lived in a 30-year period when rates of interest have declined and that world is coming to an end,” said Richard Dobbs, a Seoul-based director of McKinsey Global Institute and co-author of the report.

While the researchers make no forecast for long-term interest rates, they estimated a return to their average since the 1970s would mean a 1.5 percentage-point increase. Costlier capital may mean that in the longer-run investors enjoy better returns from fixed-income investments and could reduce the value of equities, they said.

The McKinsey researchers estimated the investment rate of mature economies has declined since the 1970s, running $20 trillion less since the 1980s than if its rate had remained stable. They’re now betting the trend will reverse as worldwide investment increases from a recent low of 20.8 percent of gross domestic product in 2002 to more than 25 percent by 2030.

House approves DREAM Act, but passage unlikely in Senate - USATODAY.com

It was the first time in the 10-year legislative history of the DREAM Act that the House has passed the bill. The vote was 216-198.

But Republicans are expected to block a vote on the bill in the Senate on Thursday, ending hopes by immigrants' rights groups and their Democratic allies to pass the Development, Relief and Education for Alien Minors Act in the final days of the 111th Congress.

Under Senate rules, Democratic leaders need 60 votes to stop an expected GOP filibuster of the bill. With little or no GOP support, Democrats are expected to fall short.

Supporters say the bill helps ambitious young immigrants who were brought here illegally through no fault of their own and want to help protect the nation as members of the U.S. military or get an education and contribute to American society.

"Think of these young people and how they identify with America — they have no other identity in many cases," House Speaker Nancy Pelosi, D-Calif., said a few minutes before the vote. "They want to use their degrees and their skills to help build something better for the next generation. That's what our founders had in mind. We owe it to our founders and we owe it to these young people and we owe it to the future to cast our votes for a bill that makes America more American."

Opponents say the bill would reward lawbreaking and encourage more parents to immigrate illegally to the U.S. with their children. Critics said it also would hurt U.S. citizens at a time when the unemployment rate remains at nearly 10% nationwide.

http://www.usatoday.com/news/washington/2010-12-08-dream-act-house-vote_N.htm

The era of mega banks – The growth of too big to fail. American banking system still backing over $13 trillion in assets with a negative deposit insurance fund. 7,760 banks but 19 banks make up 50 percent of the asset base.

- osted by mybudget360 in FDIC, bailout, banks, debt, economy, i-banking, wall street

- 0 Comments

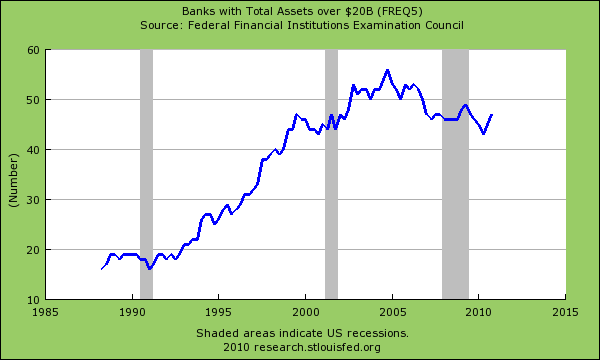

The growth of the too big to fail bank is something that is modern to this era. In the 1990s there were fewer than 40 institutions that had total assets above $20 billion. In the late part of the 1980s and 1990s this number was below 20. The peak was reached in 2005 with 55 institutions having more than $20 billion in total assets. That number has fallen in recent years because of the crisis yet we have a handful of banks that control most of the nation’s banking assets. The total U.S. banking system as of today supports over $13 trillion in total assets. The FDIC insures these deposits with a deposit fund that is negative so it might as well be supported by pure faith. What makes up most of these assets are residential and commercial real estate loans. As we have discussed banks have yet to come to terms with the reality that many of these loans are not worth what they claim they are. First, let us look at the growth of too big to fail.

The chart is unmistakable in the modern era growth of mega banks:

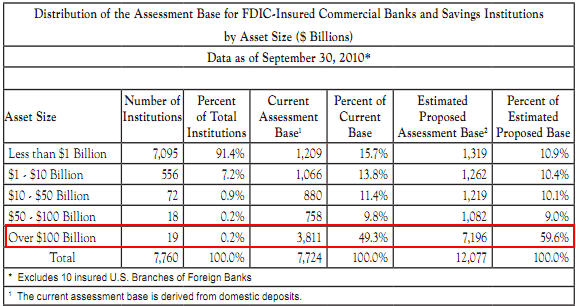

You can see that in the mid-1990s the growth in too big to fail took off. It hit its pinnacle in 2005. There is nothing inherently good about massively giant institutions and we have seen the ramifications of failure with Lehman Brothers and Bear Stearns to mention a couple notable collapses. Even though the U.S. banking system has 7,760 banks 19 banks make up 50 percent of the asset base:

Source: FDIC

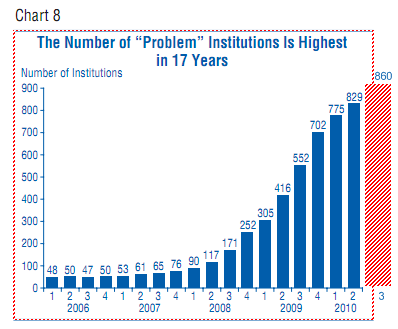

The more disturbing thing is that most of the bigger banks are the institutions with the weaker balance sheets. But look at the above chart. 7,095 banks can completely fail and only 15 percent of the total asset base would disappear. It shouldn’t be surprising that the list of troubled smaller banks is growing:

But didn’t you say smaller banks were doing better than bigger banks? They are for the most part but many of these smaller banks don’t have the same kind of relationship with theFederal Reserve and don’t have the leverage of say a JP Morgan or Bank of America. Looking at recent banking profits the bulk of the money being made isn’t on a strong U.S. bank customer, but by speculating through their investment units around the world. This can take the form of speculating in commodities, stocks in emerging countries, or anything else. When you can borrow at zero percent it isn’t too difficult to turn a profit but it is certainly not benefitting the American economy especially the working and middle class.

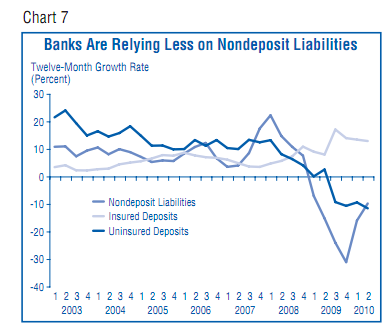

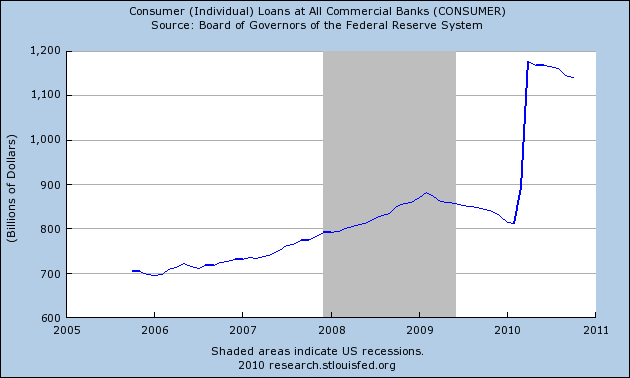

Consumer and individual loans did spike up in 2010 due to easy money and banks being flush with funds. Yet this is now tapering off:

At the same time, is this even something to be happy about? The American consumer is over leveraged so adding more debt doesn’t seem to be the solution here. Banks can only make these loans because the Fed is determined to dilute the U.S. dollar and hopefully, in their eyes at least, inflate away current debts including horrific bets on commercial real estate.

Even in recent years it has become very clear that bankers are relying on more questionable assets to constitute their investment base:

Many observers agree that the current banking system is insolvent and the only thing keeping it afloat is by suspending accounting laws that require mark to market. We have seen this translate into banks moving slowly on bigger priced foreclosures on residential properties but also commercial buildings. The banking system problems of 2007 are still largely present as we end 2010. The only difference now is that they have managed to link up their failure to the U.S. dollar directly. This is why the Federal Reserve is embarking on the quantitative easing path.

Mega banks need to be broken up and a separation between investment and commercial banking is an absolute necessity. It is incredible that no politician (or group of) has taken this up.

“Many Americans are now coming to the stark realization that Washington D.C. and their representatives no longer listen to their voice. They listen to lobbyists and banking interests.”

If you recall, the bailouts were largely opposed and the public railed against their constituents. The first vote did not pass the bailout and then politicians used fear and went ahead anyway. This was not the will of the people. Also, it is insulting that nothing was attached to the bailout funds. For example, a stipulation could have been put to break up the banks as a condition of the bailouts. Instead a blank check was given and here we are back with the same system of mega banks and no protection for the people. If our politicians were in a contest for best negotiator they would come in absolute last.

They say this was necessary or the economy would have been even worse. Well let us look at the unemployment rate now versus when the bailouts largely took place:

September 2008: 6.2

November 2010: 9.8

Then we hear the Federal Reserve saying it would have been 25 percent if it weren’t for the bailouts. Really? What would it have been if the Fed actually did its job and prevented the housing bubble from taking place to begin with by regulating and enforcing laws against the banks? Do people really trust these guys?